Opinions expressed are solely my own and do not express the views or opinions of my employer.

A few months ago, I had not heard of web3. Now it feels like I am hearing it everywhere. Web3 is attracting so much attention that even mainstream outlets like NPR are picking it up and we are on the precipice of a technological breakthrough.

I recently read a post, where the author says:

“Some days I feel like the holy trinity of NFTs, DAOs, and DeFi might replace the very foundation that society rests on. Other days it feels like 90% vaporware and Ponzi schemes that collectively emit more CO2 than a medium-sized country. The challenge is to hold both of those ideas at once”

Couldn’t agree more…

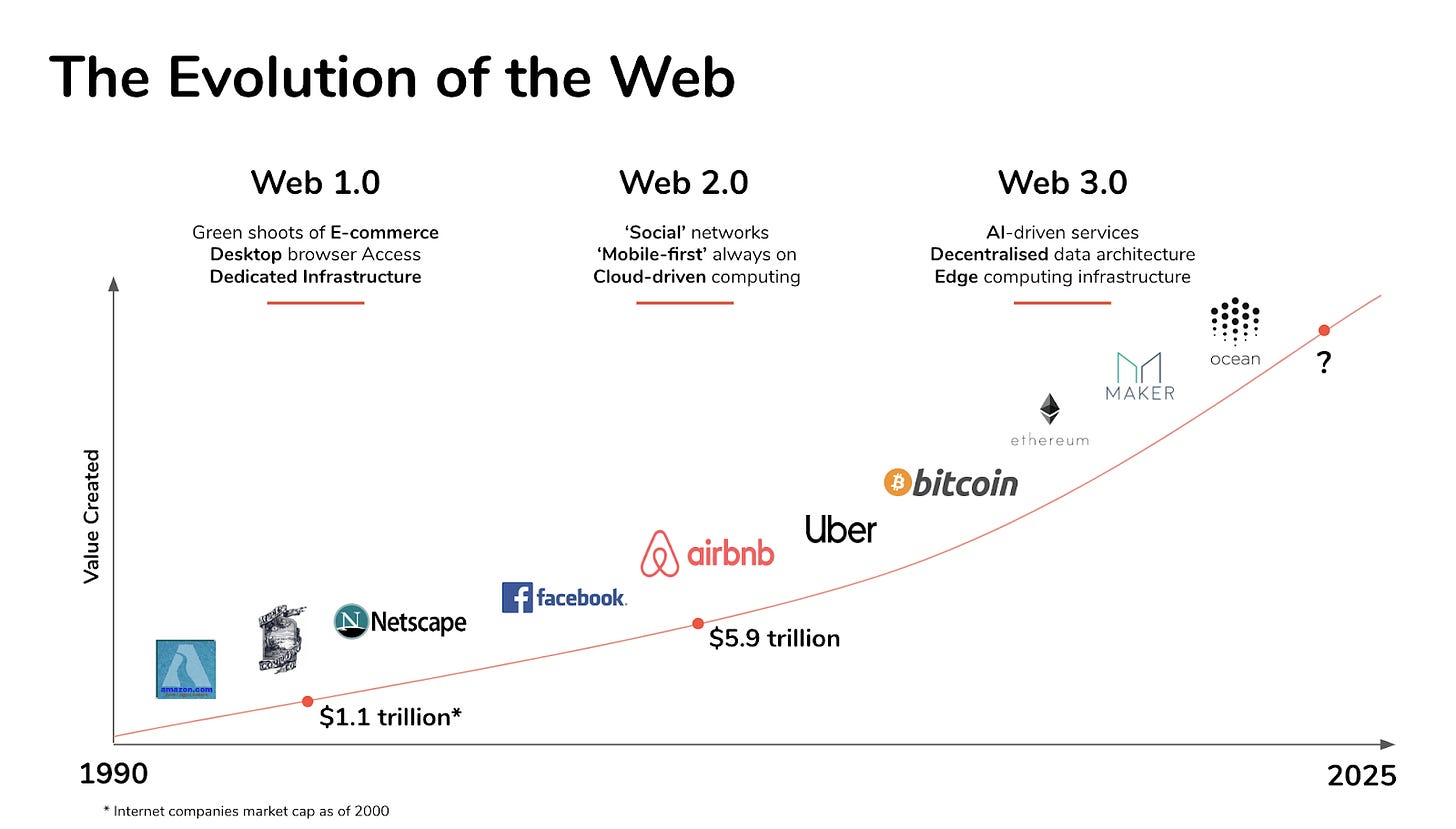

To understand Web3, we need to take a journey through Web1 and Web2.

Source: https://digitalcommunications.wp.st-andrews.ac.uk/files/2021/03/evolution-of-the-web.png

Web1: The early days of the internet (1994 - 2004). They were primarily static sites serving content digitally.

Web2: 2005 - today. Evolution of the internet to include apps built on it providing greater user engagement as well as user created content on the internet. E.g. Social media platforms (MySpace (RIP), Twitter, Facebook, Instagram), Content platforms (Youtube). Users expanded beyond individuals to enterprises.

Common criticisms of web2 state big companies have maximum control:

They control the data and where it is stored,

They control algorithms that can be blockers between content creators and their consumers,

They don’t pay for the user-generated content that drives engagement on their platform, and

Control lies with 4 - 5 big tech companies and is oligopolistic

Web3: We are still in the very early stages of Web3 and its promise is it allows for the creation and governance of an internet owned by the users and builders.

Use cases for Web3 are still evolving but some of the most popularly identified ones are NFTs (non-fungible tokens), DAOs (decentralized autonomous organizations): token based communities and DeFi (decentralized finance).

Tokens

Tokens can be fungible or non-fungible. Fungible (i.e able to be substituted for something of equal value or utility; interchangeable, exchangeable, replaceable) tokens can be exchanged with something identical. Currency (crypto and regular fiat) is an example of a fungible token.

NFTs

“Non-fungible token (NFT) is used to describe a unique digital asset whose ownership is tracked on a blockchain, such as Ethereum. Assets that can be represented as NFTs range from digital goods, such as items that exist within virtual worlds, to claims on physical assets such as clothing items or real estate.” - Linda Xie

NFTs have been all the buzz recently with “NFT Coachellas” like NFT.NYC and art works being sold for millions. NFTs are a nebulous concept and we may all try to make sense of it in different ways. For me, music has been an approachable way to understand it since we are accustomed to consuming music digitally more so than art.

NFTs help content creators gain the power to go directly to their users as opposed to going through intermediaries. For example, a musician can choose to sell directly to their fans versus through recording labels or Spotify.

Many musicians including well-established ones like Taylor Swift and Kanye West don’t often own the master records to their music and don’t make much revenue from its secondary sales. The recent furor with Taylor Swift rerecording her album Red showed the completely unbalanced power recording labels hold over artists. The record label owned all the rights to her original music and when the music rights were sold recently for millions, Taylor got nothing from it!

Through an NFT, Taylor could go directly to her fans to sell her music and earn the full profits. The NFT can be enabled with a smart contract so that future resales of the musical rights will still generate returns to her.

Currently there are explorations underway on how NFTs can be tied to real world assets. The possibilities could be myriad and are in nascent stages.

DAOs: Token based communities

DAOs are decentralized autonomous organizations that are set up around a mission. Members of the DAO have transparency into actions and transactions taken by the DAO since they are all on a public blockchain. Members can earn voting rights on the DAO by buying tokens or earn them by performing tasks for the DAO.

“Tokens align network participants to work together toward a common goal — the growth of the network and the appreciation of the token.” - Chris Dixon

DAOs have the potential for democratizing the internet, providing transparency and allowing for greater online collaboration.

There are however plenty of issues and kinks to be worked out:

If DAOs allow users to buy tokens, singular entities with deep pockets can buy a majority share rendering all other votes useless

While DAO protocols are governed by the rules coded into the blockchain, there is no legal precedent for dealing with disputes

A democratic way of decision making can be slow if decisions need to be made rapidly i.e times of great stress

and more…

Recently a group of members came together to form the “Constitution DAO” to buy one of the original copies of the constitution at a Sotheby’s auction. In a matter of days, the DAO raised $40mm of ETH through members who were all issued $People token to the DAO.

However, they lost the auction to a hedge fund CEO and that’s where things unraveled. It quickly became apparent it wasn’t clear how the DAO would be disbanded, or what they would do with the funds raised if not returned. Such kinks are par for the course in the wild west of web3, just like other gold rushes of the past.

DeFi

DeFi is a developing area at the intersection of blockchain, cryptocurrencies and traditional finance (‘tradfi’) and it aims to offer financial services (payments, lending, trading, investments, insurance, asset management etc) in a decentralized fashion thereby removing costs, regulatory and cross border constraints. This is a much more involved area, which I will discuss in depth in my next post.

“It’s just a toy” or is it?

New technology can be expensive (lacking scale), kind of clunky and often may not solve real problems. So they get dismissed as “just a toy”. Over time and iterations, depending on the technology’s trajectory it could overtake incumbent technology.

Think about the iPhone -- when it was originally launched at $1000, it was dismissed as being too expensive. We did not imagine that it would become a mini computer in our hands and as more apps were created for it, it became more useful and ubiquitous.

This has been helpful framing for me as I think about web3/crypto and think through the possibilities…

Hope you find these weekly primers helpful. If you liked this, please subscribe by hitting the button below. Until next time!